India's economy is growing dynamically and the pace of growth is increasing, while it is slowing in China, for example. This is all the more astonishing as there have been considerable negative impulses in the past two years. The sudden demonetization of the economy and the clumsy introduction of the National Value Added Tax (GST) have processed the Indian economy in an admirable way, which once again shows the difference between China and India: While the development in China seems to be taking place strongly because of the government, India is growing in many areas despite the often very poor governance and still unefficient structures. The strengh of India comes bottom up.

why india

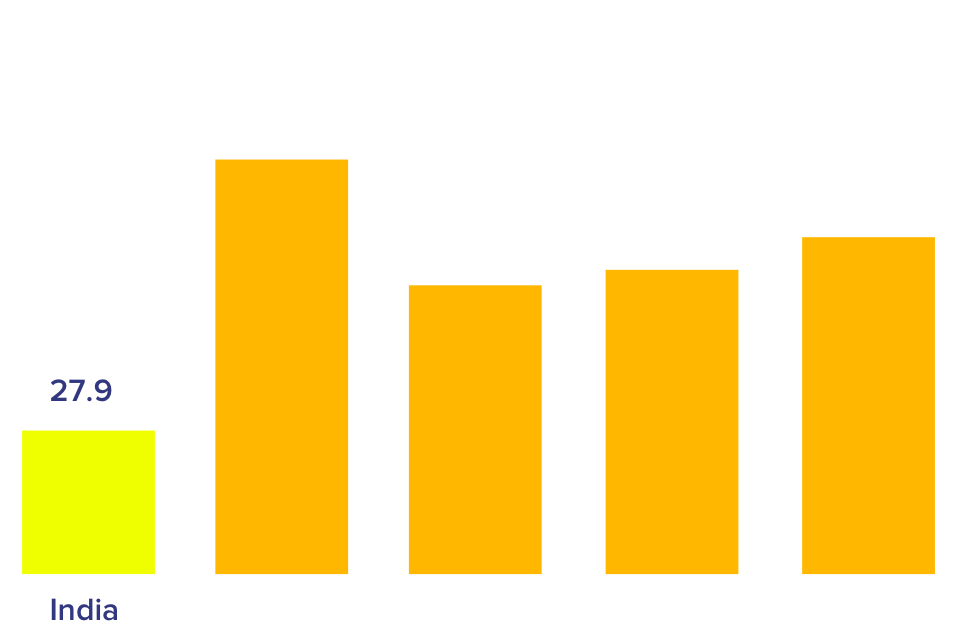

With an average age of almost 28 years, the Indian population is extremely young. Young people have goals, wishes and needs and a lot of motivation. Young people have few established habits and sources and are curious about, what is a very advantageous climate for providers of digital products and services.

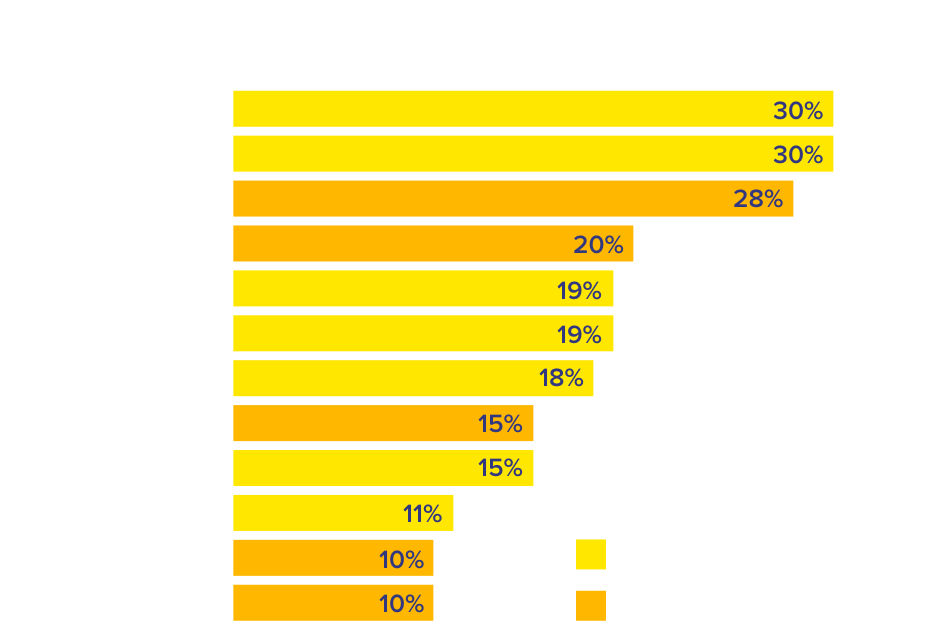

Already today there are more Indians on the Internet than there are people living in the USA at all. However, this is based on a still rather low online penetration. India's Internet population is growing at an average of 31%, significantly faster than China, for example, or any other major economy in the world.

The number of Internet users in India is growing faster than in any other major country in the world. The pace of growth is increasing and by the end of 2018 more than half a billion Indians are expected to be active in the network.

Private consumption is not growing as fast in any major economy as in India. Some former BRIC countries are seeing recessionary, negative growth. The growing incomes of the Indian middle class, combined with the rapidly changing structures towards the small family model, are leading to a perfect shopping storm.

While in western countries trade is largely structured via larger companies, franchises and branches and via organised supply chains, this is far from the case in India.

Only 8% of Indian retailers can be described as "modern" in procurement, presentation and marketing. This is a tremendous opportunity for e-commerce providers.

While shopping malls are being built all over the country that meet modern requirements and the stationary retail trade is growing well (CAGR 32%), e-commerce sales are growing twice as fast in the same period (CAGR 63%).

When several waves overlap, the perfect wave emerges:

Incomes rise... social structures change and shrinking households need their own equipment... the Internet spreads to the far corners of the country and society... cities grow... consumers develop confidence in the Internet as a source of information and communication... E-commerce is exploding.

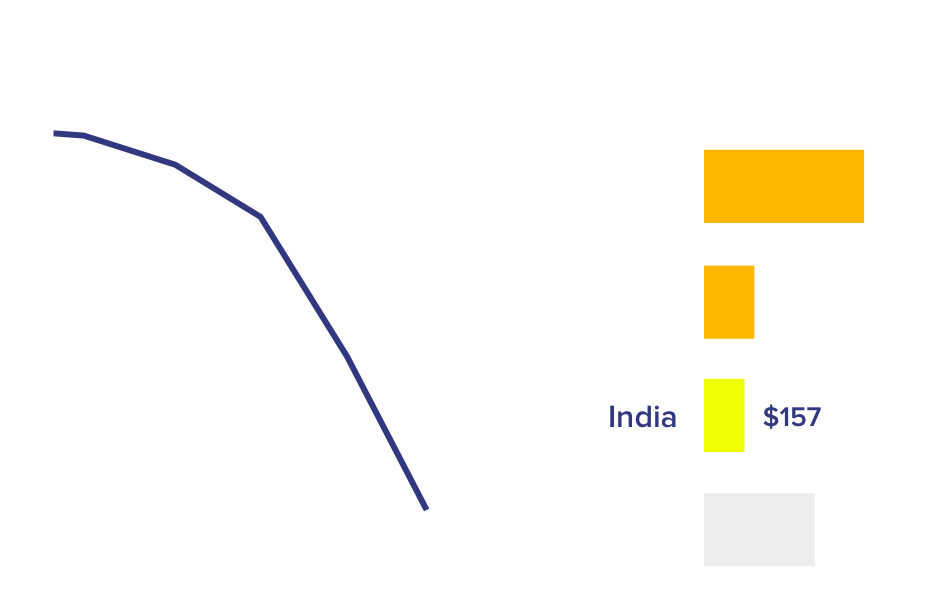

The presentation of a $4 smartphone in India caused an international media response in 2017. Meanwhile, this scoop has turned out to be fake and deception.

Indian reality is not much different: The average price of smartphones in 2017 was $157. Many of them were made in China but also in India itself. Of course, the equipment is often rather bad compared to western smartphones, the screens have lower resolution and the storage capacities are much smaller. However, one must bear in mind that the average price in the West is about 3.5 times higher! In the light of that the offered devices are very good and attractive.

2016/2017 the Reliance Group launched the mobile network Jjio and shocked all long-established competitors with extremely aggressive pricing (data for free!) and aggressive marketing. For Indian consumers, on the other hand, very pleasing times have begun, as prices have fallen very quickly since then.

The number of app downloads shows how quickly Indian users have arrived in the Mobile Age. In 2017, more apps were downloaded from app stores in India than in the USA. Nowhere else is the penetration of social media in society stronger and its use is growing faster than in India. As a result there are many opportunities to advertise products and services fully "social". Especially as Indian consumers like to intensively discuss purchases, gather information and talk about product experiences with their peers.

India is a real Mobile Only country in many areas. Smart phones are not only used for communication, social media or content. Smart phones are real transaction devices. Banking and shopping with the smart phone are a matter of course.

Unified Payments Interface (UPI) is an instant real-time payment system developed by National Payments Corporation of India facilitating inter-bank transactions. The interface is regulated by the Reserve Bank of India and works by instantly transferring funds between two bank accounts on a mobile platform on zero cost.

Virtually all product segments are experiencing significant e-commerce growth rates. The distribution of digital media products is certainly still suffering from lax ideas about copyrights among Indian consumers.

The biggest barrier to Indian e-commerce is the continued low network speeds of mobile operators. Even in conurbations, good high-speed availability cannot be assumed everywhere. In India, too, there are often unsightly dead spots in rural areas. The rapid expansion of 4G gives hope, but Indian app developers still have to adapt to this situation and take appropriate offline precautions.

In 2018 alone, 63 million Indians have started using social media and growth continues unabated. More Indians use Facebook than in any other country. WhatApp is ubiquitous in Indian life.

Among the top 10 most used social media apps there is no Indian offer. Facebook, Youtube and Whatsapp dominate the field. The Indian Hike, however, is far behind. As desirable as a local player would be for the Indian ecosystem, it is so easy to understand the localities of action for European investors.